Bupa Ambulance cover for singles, couple and families.

Table of Contents

If you’re looking for ambulance cover, you might feel a bit overwhelmed with all the choices. However, don’t worry—we’re here to assist! For Bupa ambulance coverage, we’ve created a straightforward and simple-to-read comparison table. You can find all the crucial details you require for various income groups and categories in this table. It’s like a quick guide to make things easier for you. Once you’ve looked at the table and narrowed down your options, you can get a more exact price quote for you and your family. This way, you can save both time and brainpower while finding the right ambulance cover for you.

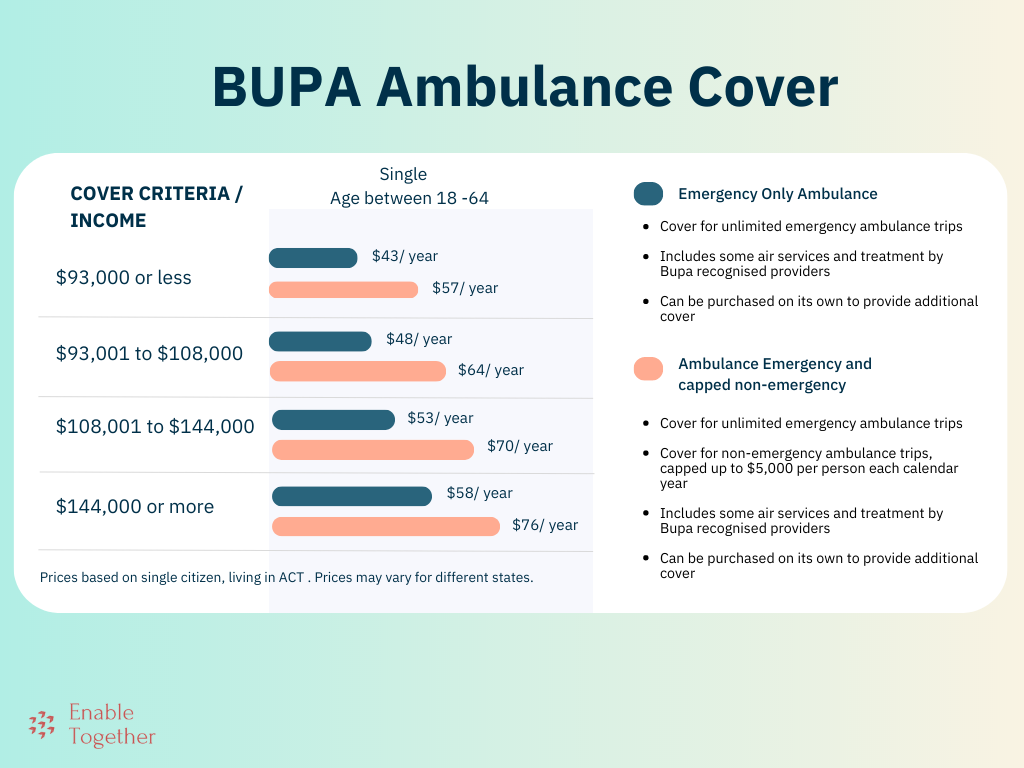

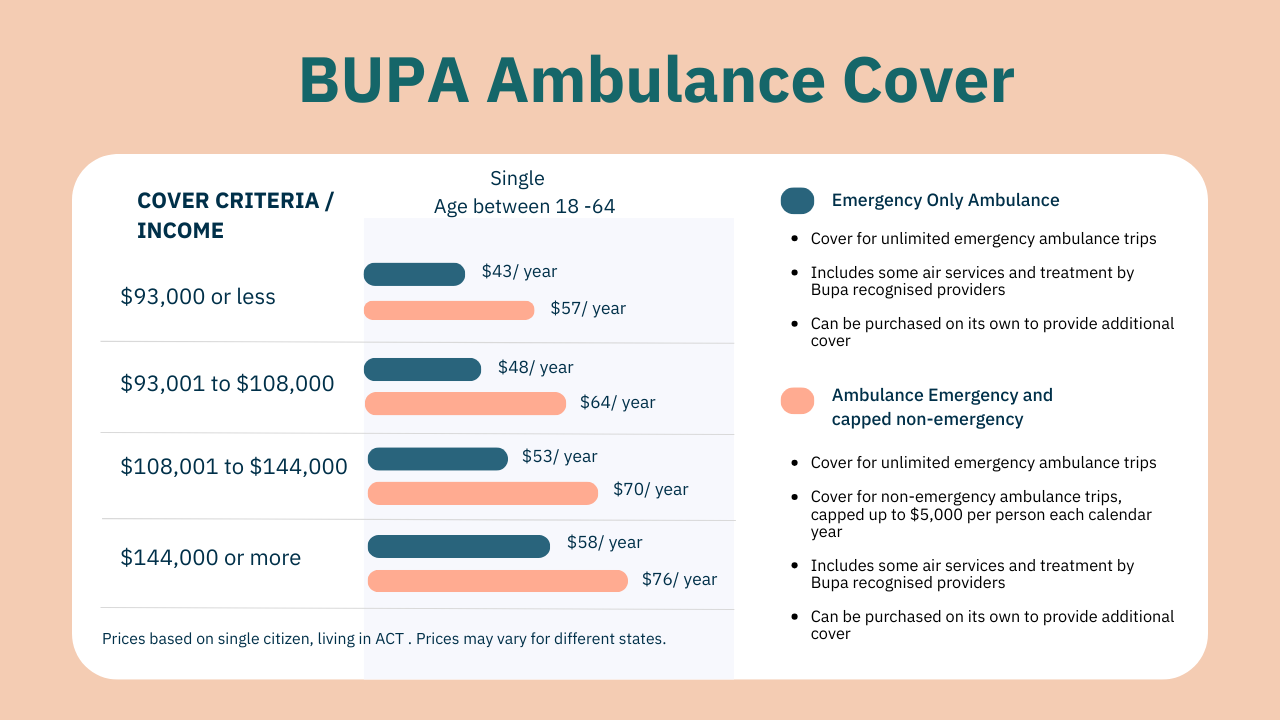

Bupa Ambulance Cover for Singles.

If you want to take a single ambulance cover and you are Australian Citizen or you have applied for or have permanent residency, then below table indicates the ambulance cover rates for individuals aged between 18-64. You must be at least 17 years old to be the person managing this cover. If you are older than 64, your insurance costs will be lower than this.

The prices of Bupa ambulance covers are also influenced by the state you are living in. For example, premium ambulance cover can charge more than double if you are living in SA or QLD in comparison to the prices of ACT or NSW.

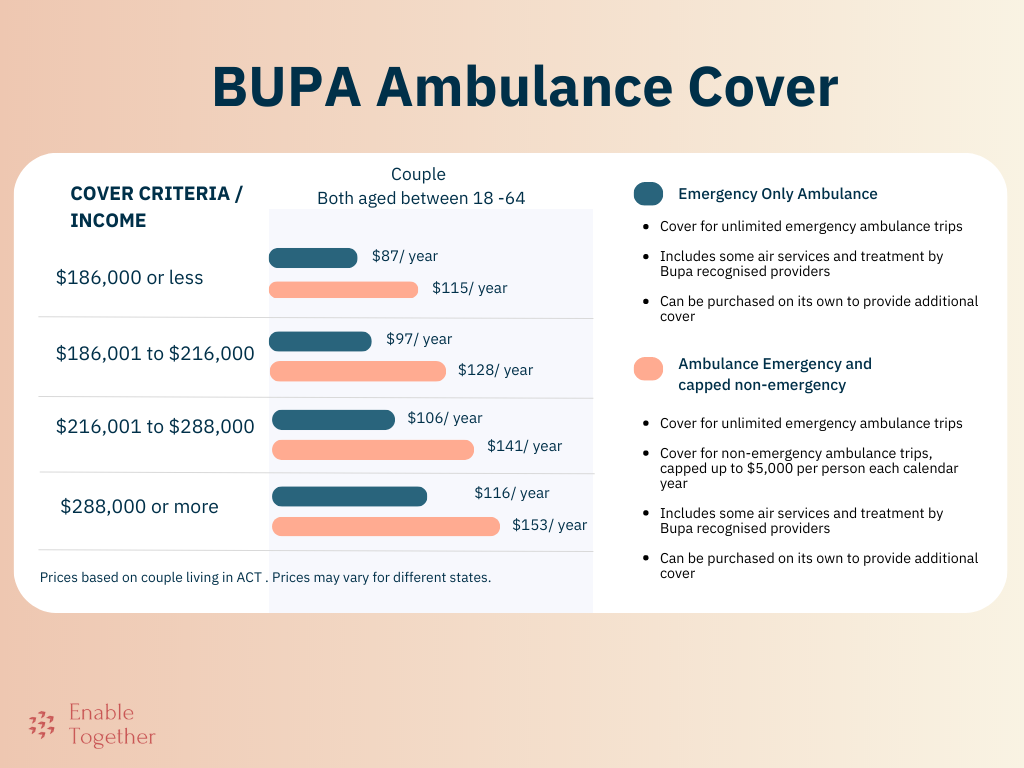

Bupa Ambulance Cover for Couples

If you’re looking for couple ambulance coverage and you are Australian citizen or have permanent residency, the table below shows the rates for couples aged between 18 and 64-years old living in ACT. To manage this coverage, you need to be at least 17 years old. If you’re over 64, your insurance costs will be less than what’s shown in the table.

Bupa Ambulance Cover for Families

The prices for families are about the same as the ones you see above for couples but if you have dependents aged 21-32 who are not full-time students, then they can’t be included on your ambulance cover, unlike hospital or extras cover. These prices also apply if you are a single parent.

How We Created These Tables?

Using an example case, we obtained quotes on August 12, 2023 from Bupa Website. No discounts or promo codes were applied. Any Age Based Discount and Lifetime Health Cover loading were excluded. All figures were correct at the time of writing.

Please bear in mind as you compare ambulance cover options detailed within the table that the premium and coverage offered to you will vary based on your age and location, as well as the citizenship and visa details if you are overseas visitor. If you need help choosing your cover, you can get an online quote for a tailored suggestion.

Prior to purchasing any insurance product, you should carefully review the full terms and conditions as listed in the Product Disclosure Statement.

What is Age Based Discount?

If you’re aged 18-29, you may be entitled to receive Age Based Discounts on your hospital cover. The discount is calculated at 2% for each year you’re aged under 30, when you first purchase hospital cover. The maximum discount is 10% for 18 to 25 year old’s.

What is the Lifetime Health Cover (LHC) loading?

LHC was introduced by the Australian Government as an incentive to have private health insurance. Someone pays it if they don’t take out hospital cover before 1 July following their 31st birthday – it goes up 2% a year, to a maximum of 70%. Any LHC that applies will be removed after someone has held hospital cover continuously for 10 years.

3 thoughts on “What is the best Bupa Ambulance Cover for you?”